This is your treasurer notconfusing speaking. I'm a tax amateur, and you can too.

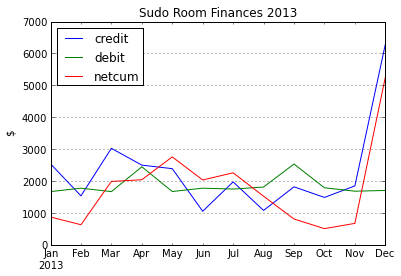

This is a visualization of 2013 finances. When debit exceeds credit we had a negative month. 'netcum' is net cummulative money aka total cash in da bank. So if debit exceeds netcum, then our month costed more than we have in the bank.

On Apr 9th 2014, I went the Sustainable economies law center legal cafe to get some advice about how sudo should handle taxes. Here's what I learned:

- Tax day for corporations is the same as for people - April 15th.

- Every year we must file something. Even if you become a

federal nonprofit, which we aren't yet, you have to tell the govt that

you don't owe anything. The basic things we need to file' are:

- State Taxes: Form 199, probably 199N

- Federales Taxes: Form 990 Likely 990-EZ.

- Those forms are actually not due until May 15th.

- I will file these soon. It's highly likely we don't owe much cash.

- 2013 was the year we switched from being "Eddan Katz" dba (doing

business as) Sudo Room, to Sudo Room, the California non-profit public

benefit corporation.

- Eddan is not claiming the income that was receieved, and it was all transfered to the new corporation.

- So the corporation will pay tax on it.

- Since we are not 501c3 yet the money "donated" to sudo room are not actually donations, i.e. not tax deductible.

- Corporations like us get 27 months after incorporation to file for 501c3. That puts our date at January 2016.

- The sudo EIN is 46-4109670