Difference between revisions of "Tax history"

Jump to navigation

Jump to search

| Line 3: | Line 3: | ||

#Tax day for corporations is the same as for people - April 15th. | #Tax day for corporations is the same as for people - April 15th. | ||

#Every year we must file '''something''. Even if you become a federal nonprofit, which we aren't yet, you have to tell the | #Every year we must file '''something'''. Even if you become a federal nonprofit, which we aren't yet, you have to tell the government that you don't owe anything. The basic things we '''need to file''' are: | ||

##State Taxes: '''Form 199''', probably 199N | ##State Taxes: '''Form 199''', probably 199N | ||

##Federales Taxes: '''Form 990''' Likely 990-EZ. | ##Federales Taxes: '''Form 990''' Likely 990-EZ. | ||

###You file 990-EZ as if you are a 501c3 even though we are not a 501c3, because we intend to be a 501c3 (that's the rules). | |||

##Those forms are actually not due until '''May 15th'''. | ##Those forms are actually not due until '''May 15th'''. | ||

##I will file these soon. | ##I will file these soon. | ||

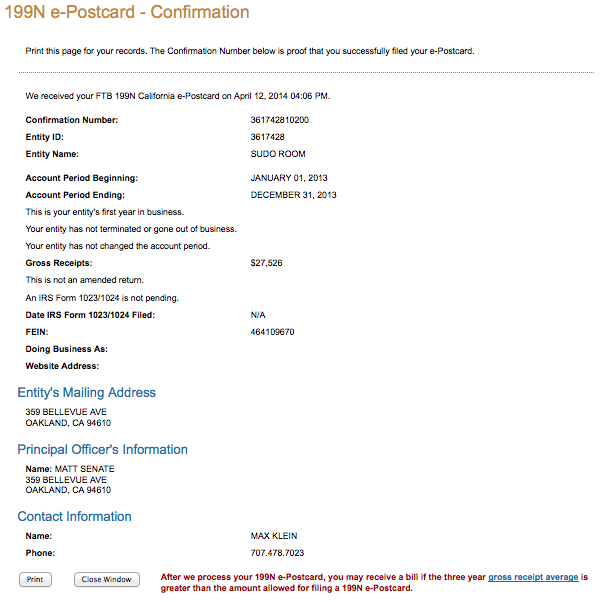

###Update State taxes done - see [[File:2013 sudo 199n confirmation.png|thumb]] | |||

###Our California EIN "Entity ID number" not federal EIN "Employer ID number" is 3617428. | |||

#2013 was the year we switched from being "Eddan Katz" dba (doing business as) Sudo Room, to Sudo Room, the California non-profit public benefit corporation. | #2013 was the year we switched from being "Eddan Katz" dba (doing business as) Sudo Room, to Sudo Room, the California non-profit public benefit corporation. | ||

##Eddan is not claiming the income that was receieved, and it was all transfered to the new corporation. | ##Eddan is not claiming the income that was receieved, and it was all transfered to the new corporation. | ||

Revision as of 15:31, 12 April 2014

2014 commenting on Calendar year 2013

This is your treasurer notconfusing speaking. I'm a tax amateur, and you can too. On Apr 9th 2014, I went the Sustainable economies law center legal cafe to get some advice about how sudo should handle taxes. Here's what I learned:

- Tax day for corporations is the same as for people - April 15th.

- Every year we must file something. Even if you become a federal nonprofit, which we aren't yet, you have to tell the government that you don't owe anything. The basic things we need to file are:

- State Taxes: Form 199, probably 199N

- Federales Taxes: Form 990 Likely 990-EZ.

- You file 990-EZ as if you are a 501c3 even though we are not a 501c3, because we intend to be a 501c3 (that's the rules).

- Those forms are actually not due until May 15th.

- I will file these soon.

- Update State taxes done - see

- Our California EIN "Entity ID number" not federal EIN "Employer ID number" is 3617428.

- 2013 was the year we switched from being "Eddan Katz" dba (doing business as) Sudo Room, to Sudo Room, the California non-profit public benefit corporation.

- Eddan is not claiming the income that was receieved, and it was all transfered to the new corporation.

- So the corporation will pay tax on it.

- Since we are not 501c3 yet the money "donated" to sudo room are not actually donations, i.e. not tax deductible.

- Corporations like us get 27 months after incorporation to file for 501c3. That puts our date at January 2016.

- The sudo EIN is 46-4109670

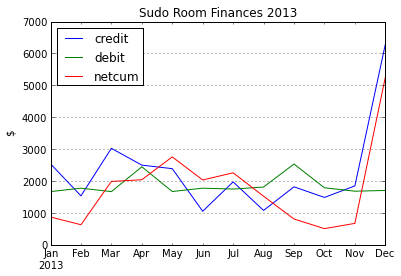

This is a visualization of 2013 finances. When debit exceeds credit we had a negative month. 'netcum' is net cummulative money aka total cash in da bank. So if debit exceeds netcum, then our month costed more than we have in the bank.