Difference between revisions of "Tax history"

(adds new header structure and section on applying for state tax exemption) |

|||

| Line 21: | Line 21: | ||

<gallery> | <gallery> | ||

File:State tax form 3500 sudo room v2.pdf|2nd DRAFT version of California State tax form 3500 for sudo room year 2013 | |||

File:State tax form 3500 sudo room.pdf|DRAFT version of California State tax form 3500 for sudo room year 2013 | File:State tax form 3500 sudo room.pdf|DRAFT version of California State tax form 3500 for sudo room year 2013 | ||

File:State not tax-exempt notice scan-1.jpg|State not tax-exempt notice scan-1 | File:State not tax-exempt notice scan-1.jpg|State not tax-exempt notice scan-1 | ||

Revision as of 14:52, 19 October 2014

Organized by "tax year" below:

2014

2013

Applying for State Tax Exemption

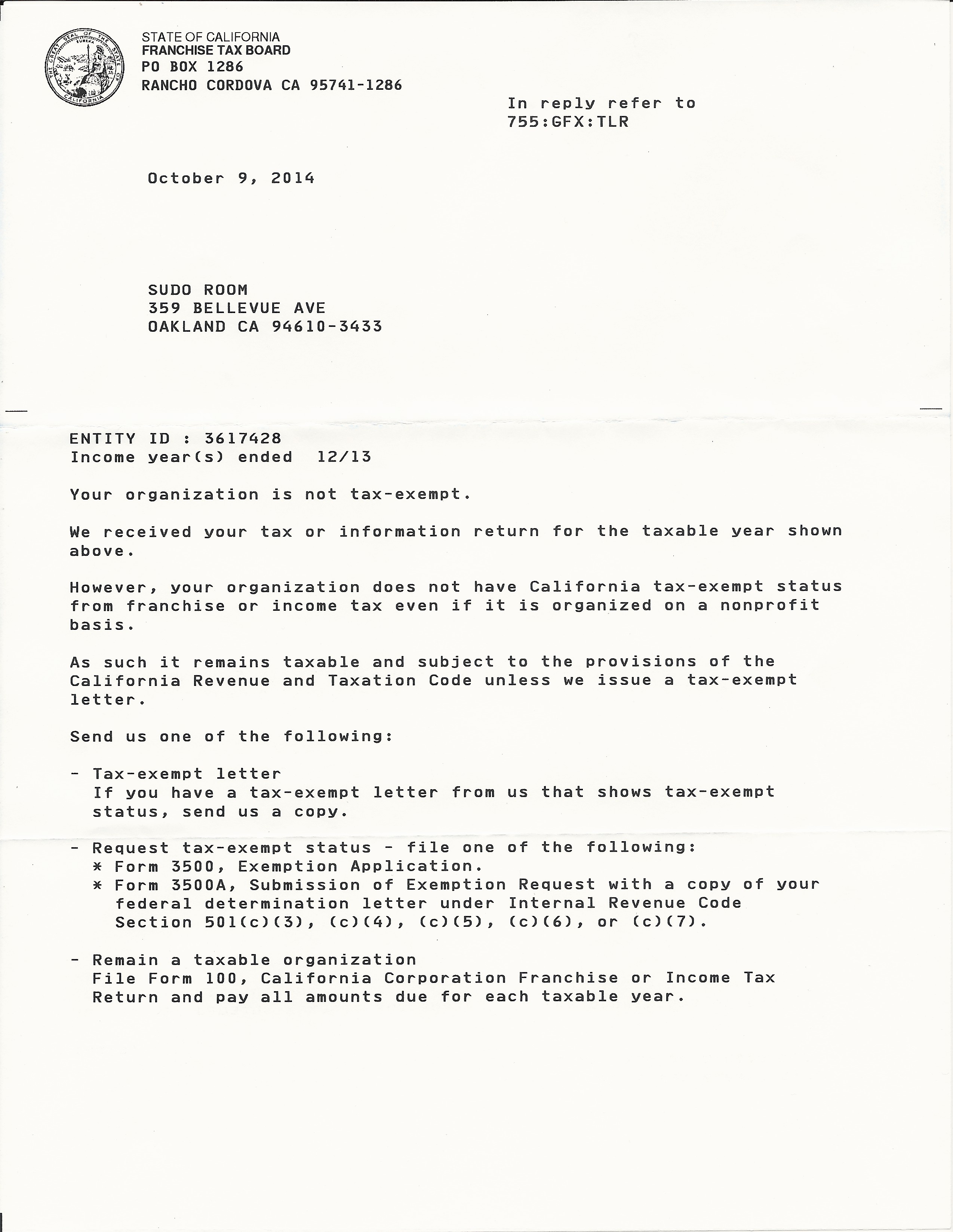

We received a notice from the State of California Franchise Tax Board, notifying us that (since we have yet to submit or complete our 501(c)3 application) we must fill out state form 3500 to convince California not to levy state taxes for last year, 2013.

I've filled out this form to the best of my knowledge so far, but it is incomplete. It needs some more attention. See attached:

File:State tax form 3500 sudo room.pdf which should have saved my submitted values to many of the required fields. We need a few things:

- Review what I've already added (make sure dates and such are correct!)

- Complete the rest of the form to the best of our ability

- See if any lawyerly advice can help us ensure this goes smoothly

- Submit before Friday November 7 (30 days from October 9, 2014)

"Send us either your tax exempt letter, Form 3500, Form 3500A, or Form 100 with a copy of this letter within the next 30 days or we may issue a tax assessment based on available information. A penalty of 25% of the additional tax may be assessed for failure to provide information upon written request."

Notes from submitting Taxes

This is your treasurer notconfusing speaking. I'm a tax amateur, and you can too. On Apr 9th 2014, I went the Sustainable economies law center legal cafe to get some advice about how sudo should handle taxes. Here's what I learned:

- Tax day for corporations is the same as for people - April 15th.

- Every year we must file something. Even if you become a federal nonprofit, which we aren't yet, you have to tell the government that you don't owe anything. The basic things we need to file are:

- State Taxes: Form 199, probably 199N

- Federales Taxes: Form 990 Likely 990-EZ.

- You file 990-EZ as if you are a 501c3 even though we are not a 501c3, because we intend to be a 501c3 (that's the rules).

- Those forms are actually not due until May 15th.

- I will file these soon.

- Update: State taxes done - see Media:2013 sudo 199n confirmation.png

- Update: Federal taxes need to be mailed Media:Sudo_tax_federal_990.pdf

- Our California EIN "Entity ID number" not federal EIN "Employer ID number" is 3617428.

- 2013 was the year we switched from being "Eddan Katz" dba (doing business as) Sudo Room, to Sudo Room, the California non-profit public benefit corporation.

- Eddan is not claiming the income that was receieved, and it was all transfered to the new corporation.

- So the corporation will pay tax on it.

- Since we are not 501c3 yet the money "donated" to sudo room are not actually donations, i.e. not tax deductible.

- Corporations like us get 27 months after incorporation to file for 501c3. That puts our date at January 2016.

- The sudo EIN is 46-4109670

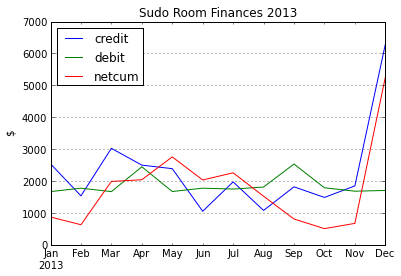

This is a visualization of 2013 finances. When debit exceeds credit we had a negative month. 'netcum' is net cummulative money aka total cash in da bank. So if debit exceeds netcum, then our month costed more than we have in the bank.